As we edge closer to yet another pivotal moment in the cryptocurrency realm—the Bitcoin halving—enthusiasts, investors, and skeptics alike are keenly tuning in to witness how this event will reshape the digital currency’s landscape. The Bitcoin halving, a fundamental feature of Bitcoin’s blockchain protocol, not only affects how new bitcoins are created but also has a profound impact on the entire cryptocurrency ecosystem. This event occurs roughly every four years, significantly reducing the reward that miners receive for adding new blocks to the blockchain.

The Concept of Bitcoin Halving

Definition and Mechanism

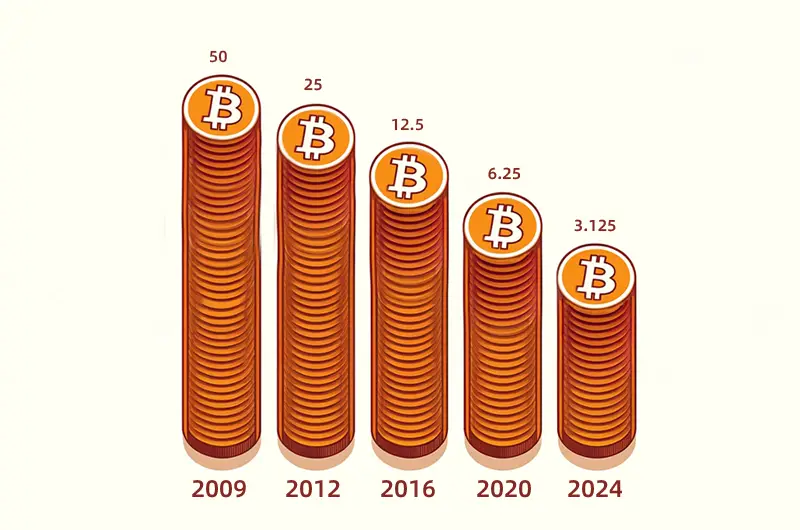

Bitcoin halving is an integral part of the design of its blockchain protocol, occurring every 210,000 blocks, or approximately every four years. This event marks the reduction of the block rewards that miners receive for verifying transactions and adding them to the blockchain. Initially, miners received 50 bitcoins per block; however, this reward halves each halving event. In the upcoming halving, the reward will decrease from 6.25 to 3.125 bitcoins per block. This mechanism is designed to control inflation and gradually reduce the rate of new bitcoins entering circulation, mimicking the extraction of a finite resource like gold.

Historical Context

The implications of past Bitcoin halvings provide a window into the potential impacts of future halvings. The first Bitcoin halving in 2012 saw the cryptocurrency’s price increase from about $11 to nearly $1,150 within a year. The second halving in 2016 witnessed a similar pattern, with prices rising from $576 to approximately $20,000 by the end of 2017. While the third halving in 2020 did not result in an immediate significant price spike, it was followed by a steady increase, eventually reaching new highs above $60,000 in 2021. These events highlight a pattern of bullish market behavior following halvings, driven by reduced supply and increased scarcity of Bitcoin.

Anticipated Changes in the Bitcoin Market

Market Trends Pre-Halving

As the Bitcoin halving approaches, notable shifts in market dynamics begin to surface. Traditionally, the months leading up to a halving event witness heightened volatility and speculative trading, with investors aiming to capitalize on potential price increases post-halving. Currently, the market is observing a significant increase in trading volume, as both retail and institutional investors increase their holdings. Analysts also report a rise in new wallet creations, suggesting an influx of new participants in the cryptocurrency market, drawn by the potential for substantial long-term gains.

Furthermore, there’s a noticeable trend in the accumulation of Bitcoin by large holders, or ‘whales’, which tends to stabilize prices at higher levels. This accumulation is often viewed as a signal of bullish sentiment among the most financially robust market players.

Predictions for Post-Halving

Predicting the exact outcome of a Bitcoin halving is complex, given the myriad of factors influencing the market. However, based on historical data and current market analysis, several likely scenarios are anticipated by experts. One common prediction is that the reduced rate of new Bitcoin entering circulation will create supply-side pressure, potentially driving up the price if demand remains constant or increases.

Economists and crypto analysts also speculate about increased adoption of Bitcoin as a ‘digital gold’ in the face of global economic uncertainty, including inflation fears. This sentiment may drive more conservative investors towards cryptocurrencies as a hedge against traditional financial market fluctuations.

Moreover, the halving is expected to trigger innovations in mining technology and strategies. Miners will need to become more efficient to maintain profitability at lower reward levels, which could accelerate the development and adoption of more advanced and energy-efficient mining technologies.

Economic Implications of the Halving

Impact on Miners

The halving dramatically affects Bitcoin miners, as the reduction in block rewards cuts their primary income source in half overnight. This drastic change forces miners to reassess their operational efficiency, as the profitability of mining becomes more dependent on the price of Bitcoin and the cost of electricity. Smaller mining operations or those with outdated technology may find it increasingly difficult to compete, potentially leading to consolidation within the mining industry. As a result, mining may become more centralized around well-capitalized entities that can achieve economies of scale with the latest, most energy-efficient mining hardware.

Broader Economic Impact

The economic implications of Bitcoin halving extend far beyond the miners. For the broader cryptocurrency market and the global financial landscape, each halving event serves as a test of Bitcoin’s deflationary economic model. This model contrasts starkly with fiat currencies, which are subject to inflationary pressures through government and central bank interventions, such as quantitative easing.

- Market Stability and Adoption:Historically, each halving has contributed to increased price stability in the months following the event, which can enhance Bitcoin’s appeal as a store of value. Greater price stability combined with increased recognition of Bitcoin’s scarcity could accelerate its adoption as a legitimate financial asset, both for individual investors and institutional portfolios.

- Investment Strategies:Investors might need to modify their strategies in response to the halving. Traditional investment approaches, such as portfolio diversification and risk assessment, may need recalibration in the context of a potentially higher-volatility asset like Bitcoin post-halving.

- Regulatory Response:As Bitcoin continues to grow in prominence and value, regulators around the world may take a more active interest in the cryptocurrency. This could lead to new regulations that might either foster and streamline Bitcoin’s integration into the global financial system or impose significant restrictions that could limit its growth and accessibility.

Strategic Insights for Investors and Traders

Investment Opportunities

The halving event typically heralds a shift in the investment landscape of Bitcoin, offering unique opportunities for both short-term traders and long-term investors. For traders, the increased volatility surrounding the halving can present opportunities for significant gains through timely buys and sells. Recognizing patterns from previous halvings can help traders predict when the market might peak or dip, allowing them to strategize their entry and exit points more effectively.

For long-term investors, the halving reinforces Bitcoin’s scarcity, potentially enhancing its value over time as a digital gold. Investing in Bitcoin around the time of a halving can be seen as a strategic move to capitalize on the anticipated appreciation in value over subsequent years. Moreover, diversifying into other cryptocurrencies that might benefit from the increased attention to the crypto space during a halving event could also prove beneficial.

Risk Management

Navigating the potential rewards of Bitcoin halving also involves managing significant risks. The primary risk is the market’s volatility, which can swing dramatically in the short term based on trader behavior and broader economic factors. Investors can manage these risks through:

- Diversification:While Bitcoin might be a focal point during the halving, diversifying a cryptocurrency portfolio to include other promising digital assets can help mitigate risk.

- Hedging:Using financial instruments such as options or futures can provide investors with ways to hedge against their crypto holdings, protecting against downside risk while still allowing for upside potential.

- Setting Stop-Loss Orders:For traders, setting stop-loss orders can help limit potential losses by automatically selling at a predetermined price.

- Staying Informed:Keeping abreast of market trends, regulatory news, and technological developments in the blockchain space can equip investors with the knowledge to make timely decisions.

Community and Industry Perspectives

Voices from the Community

The Bitcoin community, a vibrant and diverse group of enthusiasts, investors, and technologists, plays a crucial role in shaping the narrative around the halving. From seasoned hodlers to curious newcomers, the perspectives and reactions within the community provide a ground-level view of the halving’s impact. Online forums, social media platforms, and cryptocurrency conferences buzz with discussions and debates about strategies, predictions, and the philosophical implications of Bitcoin’s deflationary model.

Members of the community often share personal stories of previous halvings, offering insights and advice based on their experiences. These anecdotes can be particularly valuable for newcomers seeking to understand the potential risks and rewards. Additionally, community sentiment can serve as a leading indicator of market trends, as collective optimism or pessimism can drive or dampen market activity.

Industry Reactions

Beyond individual investors and traders, the Bitcoin halving prompts reactions from key players in the cryptocurrency industry, including exchanges, wallet providers, and mining operations. These entities often adjust their strategies and offerings in anticipation of the halving to accommodate the expected influx of activity and the changing needs of their users.

- Exchanges:Cryptocurrency exchanges might ramp up their infrastructure to handle increased trading volume, offer special promotions, or introduce new trading pairs. These platforms play a critical role in providing liquidity and enabling price discovery during volatile periods.

- Wallet Providers:Wallet providers may update their features to enhance security and improve user experience. New services, such as enhanced custody solutions or integrated investment tools, can help users manage their assets more effectively during and after the halving.

- Mining Companies:The halving significantly impacts miners due to the reduced block reward. In response, mining companies might deploy more energy-efficient mining rigs or shift operations to regions with lower electricity costs. Some may also diversify their revenue streams, venturing into other sectors of the blockchain ecosystem to maintain profitability.

Conclusion

As we’ve explored throughout this article, the Bitcoin halving is more than just a scheduled reduction in the miner’s reward—it’s a significant event that has far-reaching implications for the entire cryptocurrency ecosystem. From the technical adjustments at the blockchain level to shifts in investor strategies and community reactions, the halving event encapsulates the dynamic and evolving nature of Bitcoin.

This upcoming halving, like those before it, promises to be a moment of transformation for Bitcoin’s landscape. It challenges miners with decreased rewards but also potentially enriches the investment landscape with heightened interest and increased asset valuation. For traders and investors, understanding the nuances of such transitions can open up lucrative opportunities while managing inherent risks.

Moreover, the broader economic impact of the halving extends beyond immediate price fluctuations. It underscores Bitcoin’s growing role as a digital asset that counters traditional inflationary currencies and highlights the cryptocurrency’s maturation in financial markets around the world.

FAQs

- What is Bitcoin Halving?

Bitcoin Halving is an event that occurs approximately every four years where the reward for mining new Bitcoin blocks is halved, thereby reducing the rate at which new bitcoins are created and released into circulation. This is a part of Bitcoin’s design to mimic the scarcity and deflationary properties of precious metals.

- Why does Bitcoin Halving happen?

Bitcoin Halving happens as a part of the predetermined monetary policy embedded in Bitcoin’s code by its creator, Satoshi Nakamoto. The purpose is to control inflation and extend the distribution of new Bitcoins over a longer period, up to around the year 2140.

- How often does Bitcoin Halving occur?

Bitcoin Halving occurs approximately every four years, or after every 210,000 blocks have been mined. This regular schedule keeps the issuance of new bitcoins steady and predictable.

- What impact does Bitcoin Halving have on the price of Bitcoin?

Historically, Bitcoin Halving has led to an increase in the price of Bitcoin in the months following the event. This is generally attributed to the reduced supply of new bitcoins and increased demand. However, market conditions, investor sentiment, and broader economic factors also play significant roles.

- How does Bitcoin Halving affect miners?

Bitcoin Halving reduces the block reward that miners receive for verifying transactions and adding them to the blockchain, which can impact their profitability. Miners need to adjust for lower rewards by improving efficiency or scaling their operations.

- Can Bitcoin Halving affect Bitcoin’s transaction speed?

Bitcoin Halving does not directly affect the speed of transactions on the blockchain. However, it can indirectly influence transaction fees if changes in miner behavior lead to slower block times temporarily.

- What are the long-term effects of Bitcoin Halving?

In the long term, Bitcoin Halving is intended to help Bitcoin achieve and maintain its value by making it scarcer over time, akin to a commodity like gold. It contributes to Bitcoin’s deflationary nature, potentially making it more appealing as a long-term investment.

- How many Bitcoin Halvings have there been?

As of the most recent data prior to 2024, there have been three Bitcoin Halvings since the creation of Bitcoin. The first occurred in 2012, the second in 2016, and the third in 2020.

- What happens when all Bitcoins are mined?

The final Bitcoin is expected to be mined around the year 2140. After that, miners will no longer receive block rewards but will continue to be compensated through transaction fees. This shift is expected to sustain the mining and transaction verification process.

- Is Bitcoin Halving considered a risky event for investors?

Bitcoin Halving can be seen as a risky event due to the potential for increased price volatility around the time of the halving. Investors should consider their own risk tolerance and investment horizon when deciding how to approach Bitcoin investing around a halving event.